Wicker: Biden makes taxpayers shoulder student debt

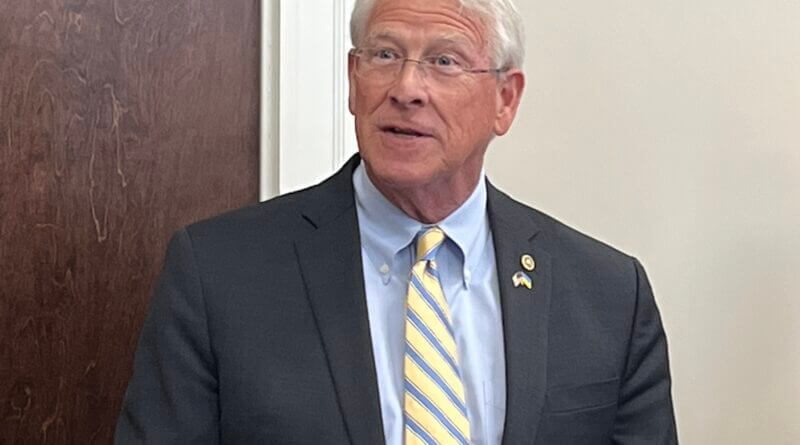

By U.S. Sen. Roger Wicker

$400 Billion Debt Transfer in Unfair to Working Americans

This past August, in a bid to improve his standing with young voters, President Biden announced that he will transfer vast sums of student debt to the American taxpayer. His plan – which is really a decree since Congress never approved it – will “forgive” up to $10,000 in student debt for eligible individuals making under $125,000 and up to $20,000 for Pell grant recipients. As executive orders go, this is one of the most expensive in history, costing an estimated $400 billion. It is also an assault on Congress’s constitutional power of the purse, as lawmakers never authorized money for this purpose.

Most notably, this bailout is an insult to working Americans who never went to college or who paid back their loans, but will now have to shoulder other people’s debts. Restaurant staff who worked their way through college and young sailors who joined the Navy instead of taking on student debt will now be paying off the loans of college graduates who are pursuing lucrative careers. Mississippians recognize how wrong this is. I have heard from numerous constituents who oppose the President’s plan and are rightly angered by it. Even some Democrats have criticized it as a wealth transfer from middle-class Americans to the rich. This election-year gambit may be the President’s most unfair idea yet.

Biden Faces Legal Thicket

President Biden is already facing legal challenges over his plan. In one case filed last week, an Indiana borrower asked a federal court to block the plan, citing imminent personal harm from a state tax on canceled debt. His lawsuit claims that Biden officials violated the Administrative Procedures Act by not following the federal rulemaking process, which would have created a “notice and comment” period allowing the public to provide input. The lawsuit also notes that the Administration failed to explain how it can justify the plan as a form of “COVID relief.” President Biden’s bailout simply has no basis in federal law. I applaud this Indiana plaintiff and hope he and others like him prevail.

Bailouts Feed Broken System

In addition to being unfair, the President’s bailout will only worsen the problems plaguing our higher education system. Over the last 20 years, the average tuition for a four-year university has gone up by 179 percent – an average increase of nine percent each year. Bailing out student loans will encourage universities to keep raising tuition. It will also encourage more risky borrowing, as many students will expect loan forgiveness from a future President. Perhaps worst of all, this bailout teaches the next generation to expect others to pay for their personal risks and obligations.

While President Biden throws money at these problems, Republicans are offering solutions to help young Americans enter the workforce with minimal student debt. For many people, a four-year college degree will be necessary and helpful. Yet many professions do not require such an investment, and I support legislation to strengthen trade schools, community colleges, and other non-four-year programs. I have also supported job training initiatives, including cyber training, coding boot camps, and shipbuilding workforce development in Mississippi. In addition, I continue to support Pell grants, which provide targeted assistance to students who need it. We can make education more affordable and accessible without punishing taxpayers if we simply think outside the box. In the meantime, I hope the courts block the President’s unlawful debt bailout and return the issue to Congress where it belongs.

Note: This item is Sen. Roger Wicker’s Weekly Report and is provided by the Senator’s office.