Wicker: No end in sight to Biden’s cruel inflation

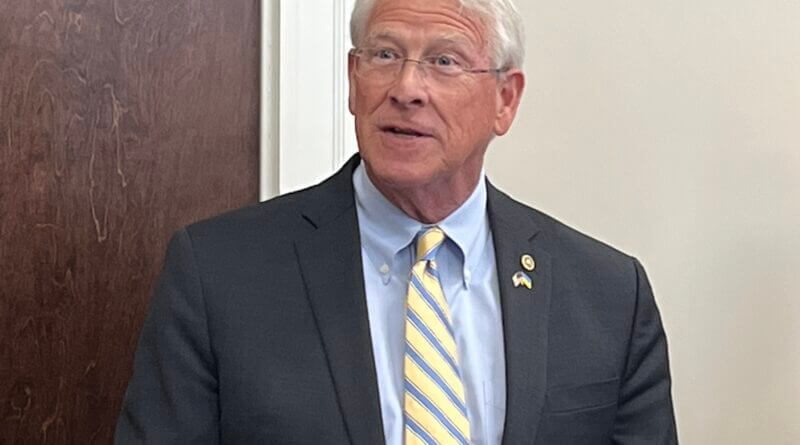

Note: The following is Sen. Roger Wicker’s Weekly Report and is provided by the Senator’s office.

Americans Crushed by 20 Straight Months of Rising Prices

Almost a year ago, President Biden declared that inflation had finally peaked at 6.8 percent, yet we have now endured seven straight months of inflation over eight percent. June was the worst month yet, with prices surging by 9.1 percent, but last month was not much better. In September, prices rose by 8.2 percent from a year ago, and “core” inflation – which omits food and energy – increased by 6.6 percent, the fastest jump in 40 years. These numbers confirm that we are not even close to being out of this inflation crisis.

Recently, at an ice cream shop, President Biden was asked if he is worried about inflation. Grasping an ice cream cone (which has risen in price by 14 percent on his watch), the President dismissed the question, saying “our economy is strong as hell.” Those words reveal a President who is deeply out of touch. In reality, our economy has been shrinking for six months – the textbook definition of a recession – and a new forecast from Bloomberg says it is 100 percent likely that the recession will continue into next year. President Biden’s agenda has clearly failed, and we are all paying for it.

Groceries, Car, Homes Become Unaffordable

For many Americans, a routine trip to the grocery store has become a cause of distress. Food prices have soared under President Biden, most noticeably for eggs (98 percent), chicken breasts (46 percent), coffee (34 percent), bacon (27 percent), flour (25 percent), and sugar (23 percent). Meanwhile, the cost of eating out has gone up by 12 percent, and those who visit a restaurant are more likely to face longer wait times because of staff shortages.

With interest rates going up, the dream of owning a home is now further out of reach for millions of Americans. Mortgage rates now stand at a 20-year high, prompting potential buyers to wait on the sidelines indefinitely. In the last year alone, the average monthly payment on a mortgage has jumped by 51 percent. This trend will likely get worse as the Federal Reserve continues raising interest rates to fight the President’s inflation.

Life is also getting more difficult for tenants, with rents increasing by nine percent under President Biden. In the same period, furniture prices have risen by 22 percent, making it harder to furnish a home. Electricity costs are also up 23 percent. And for those who want to keep warm this winter, home heating bills are expected to hit a 25-year high. Even at home, there is no escaping the President’s rampant inflation.

Inflation Raids Family Savings

High prices are forcing many Americans to cut into their savings just to stay afloat. Since the President took office, monthly savings have fallen by 83 percent, and inflation has wiped out a month’s worth of earnings for half of American workers. Pension funds have declined in worth by 15 percent, and the average 401k has lost a quarter of its value because of the economic downturn, forcing many older Americans to delay retirement or reenter the workforce.

Republicans Show the Way Forward

This economic pain is a direct result of the President’s agenda. In less than two years, he and his Democratic majorities in Congress have managed to turn our economic recovery into an inflationary recession through tax-and-spend policies. Republicans are offering a way forward with plans that would ease inflation, spur economic growth, and lower the cost of energy.