Wicker Pushes IRS to Clear Backlogs

Taxpayers Deserve an Easier Tax Season This Year

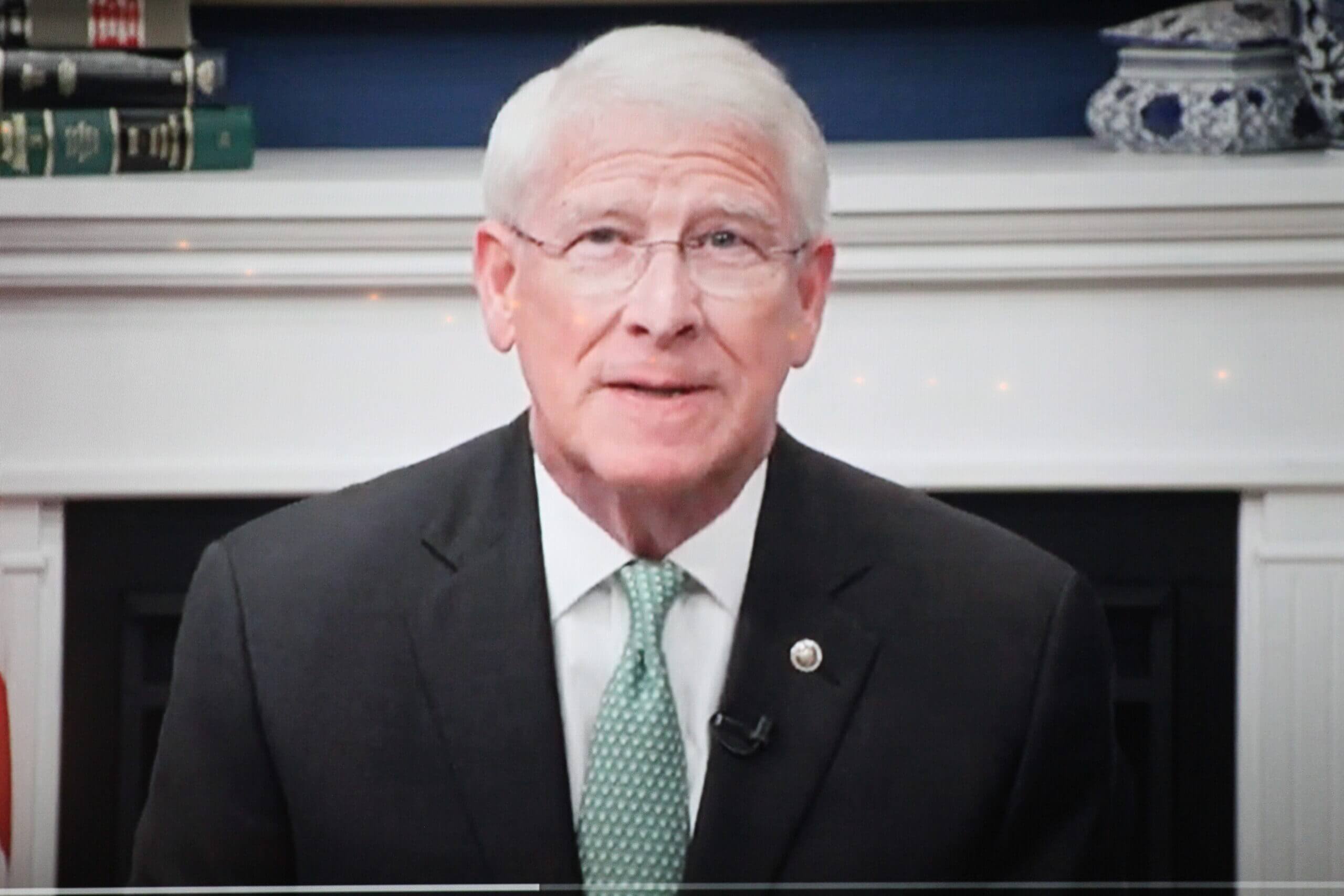

Note: The following is Sen. Roger Wicker’s weekly report and is provided courtesy of the Senator’s office.

With tax season upon us, Americans are beginning to sift through W2s and 1040s in preparation for Tax Day. Yet many of us are apprehensive after last year’s long IRS delays and are wondering if this year will bring similar headaches. Even today, nine million Americans are still waiting for their 2020 tax refunds and are finding it almost impossible to speak to the IRS. According to the Taxpayer Advocate Service, only 11 percent of callers have gotten through to the IRS in the past year, and those who submit a written message are waiting up to six months or longer for a response. These delays are adding to the financial uncertainty already facing many Americans.

I have heard from many Mississippians who tell me about hardships they are experiencing because of IRS delays. One married couple filed an amended tax return and was told to wait 16 weeks. It has now been over 72 weeks, and they are still waiting for their refund. They live on a single income and have been unable to make needed repairs to their home, which was damaged by Hurricane Zeta. There is simply no excuse for the IRS withholding their money for so long.

I have intervened in many cases like this, but the IRS continues to be bogged down by their own staffing problems. If this tax season is going to be any smoother than last year, Congress needs to address the problem.

Congress Pushes IRS to Provide Relief

The first step in clearing these backlogs is for IRS employees to return physically to the office. Unfortunately, most federal agencies are still not fully back in person, even as most American workers have returned to the workplace. Out of 20 federal agencies I contacted about reopening (including the IRS), only one could give me a rough sketch of a reopening plan. This is simply unacceptable and is slowing down the work of government. To address this problem, I am drafting legislation called the RETURN Act. This bill would require federal agencies to submit a simple reopening plan to Congress, clearing the way for more efficient service for taxpayers.

Until legislation can be passed and signed into law, Congress needs to exercise its oversight responsibilities. Members of Congress recently sent a bipartisan letter to the IRS urging them to ease the tax filing process. Specifically, it recommended that the IRS delay automated tax collections, speed up processing for amended returns, and reduce penalties for those who have paid 70 percent of their taxes since 2020. These simple steps would alleviate some of the stress taxpayers have dealt with during the pandemic.

The Good News: Taxes Are Still Lower

Despite the headaches caused by IRS bureaucracy, Americans can take comfort that President Biden’s high-tax proposals have not become law, leaving the Republican-passed tax cuts of 2017 in place for now. This year, Americans will continue to pay lower tax rates than when President Obama left office, and small businesses will continue to pay at a 21 percent rate – down from 35 percent, which was the highest in the developed world.

With only nine months left before the midterm elections, Democrats are still trying to pass some form of tax increase. Senator Chuck Schumer remains fixated on restoring a huge tax benefit for the super-rich in high-tax states like New York, while at the same time burdening most American job creators with higher taxes. Democrats have even proposed forcing Americans to disclose bank transfers of over $600 to the IRS, a stunning intrusion on basic privacy. So far, a few stalwart Democrats have stood with all Republicans against these high-tax proposals.