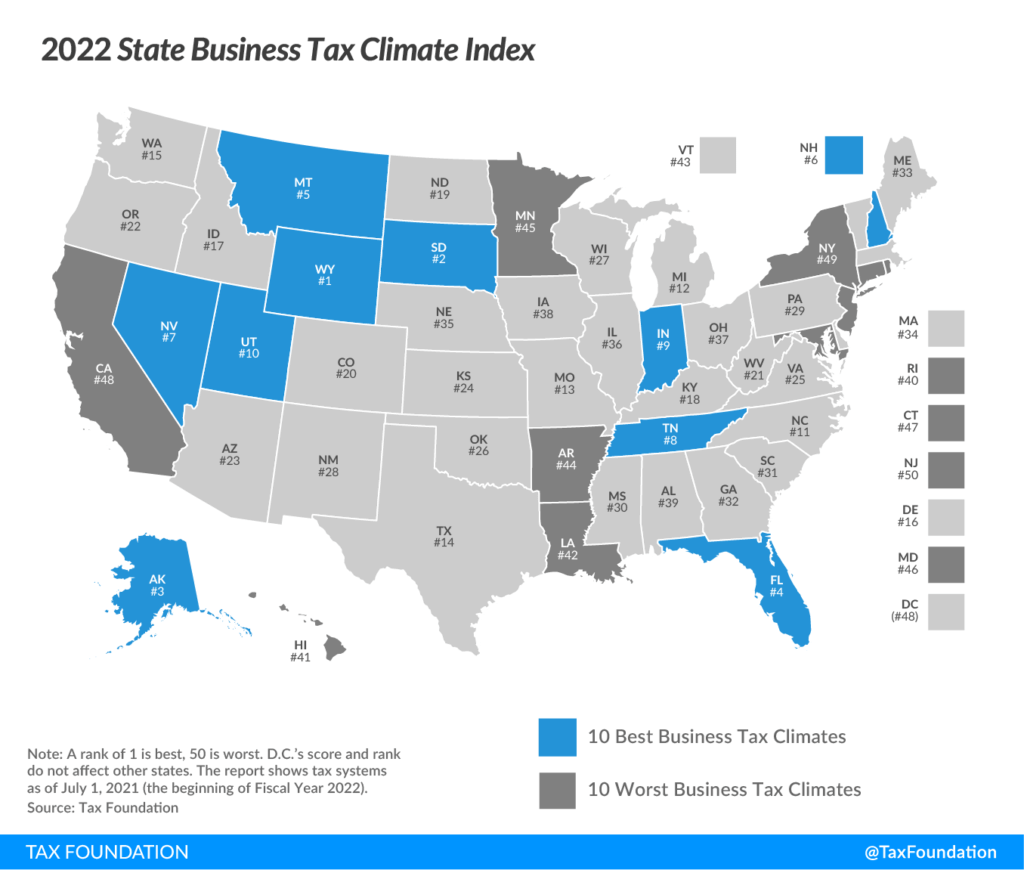

Mississippi 30th in State Business Tax Climate index

A new report from the Tax Foundation rates Mississippi 30th in its 2022 State Business Tax Climate Index.

According to its website, the Tax Foundation “is the nation’s leading independent tax policy nonprofit. Since 1937, our principled research, insightful analysis, and engaged experts have informed smarter tax policy at the federal, state, and global levels.”

The index is a way for business leaders, government policymakers, and taxpayers to gauge how their states’ tax systems compare. The Index is designed to show how well states structure their tax systems and provides a road map for improvement.

The results list these states as the most tax-friendly:

1. Wyoming

2. South Dakota

3. Alaska

4. Florida

5. Montana

6. New Hampshire

7. Nevada

8 Tennessee

9. Indiana

10. Utah

The index said the absence of a major tax was a common factor for many of the top-10 states.

Meanwhile, these states were labeled at the bottom of the list:

41. Hawaii

42. Louisiana

43. Vermont

44. Arkansas

45. Minnesota

46. Maryland

47. Connecticut

48. California

49. New York

50. New Jersey

The entire report and state-by-state breakdown is found on the Tax Foundation website.