Income tax elimination bill passes House

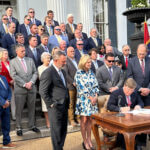

Three DeSoto County state representatives are among additional authors to a bill presented by Mississippi Speaker of the House Phillip Gunn, Speaker Pro Tempore Jason White, and state Rep. Trey Lamar (R-Senatobia), that would lead to the elimination of the state income tax in the state. The measure this week passed the House on a vote of 85-34 and is on its way to the state Senate for consideration.

The additional authors of the measure, House Bill 1439, include state representatives Dan Eubanks (R-Walls), Dana Criswell (R-Olive Branch), and Bill Kinkade (R-Byhalia). Kinkade’s district includes parts of Marshall and eastern DeSoto counties.

They voted for the measure in the final vote, along with Reps. Jeff Hale (R-Nesbit), Jerry Darnell (R-Hernando), and Bruce Hopkins (R-Southaven). State Rep. Hester Jackson-McCray (D-Horn Lake) voted against the measure.

Called the Mississippi Tax Freedom Act of 2021, the measure would eliminate individual state income taxes for those who earn up to $50,000 annually, and couples who earn up to $100,000 annually between them. The bill would also increase those income limits over a 10-year period.

A phased-in cut of grocery sales taxes would also take place toward a reduction of those sales taxes in half.

Meanwhile, to make up the difference in lost tax revenue, some sales taxes would be increased.

For instance, the general sales tax and liquor sales tax would grow to 9.5 percent. Farm equipment and manufacturing machinery sales tax would be raised to 4 percent, and the sales tax on vehicles, airplanes and mobile homes would grow to 5.5 percent.

Eliminating the state income tax has been supported by Gov. Tate Reeves although he has not fully supported the bill that passed the House.

The bill’s future now lies in the Senate where the Lt. Gov. Delbert Hosemann, President of the Senate, has offered some concerns about the specifics.

If signed into the law, the bill would be effective July 1.