Assessor sets all-time record for Homestead filings on day one of filing season

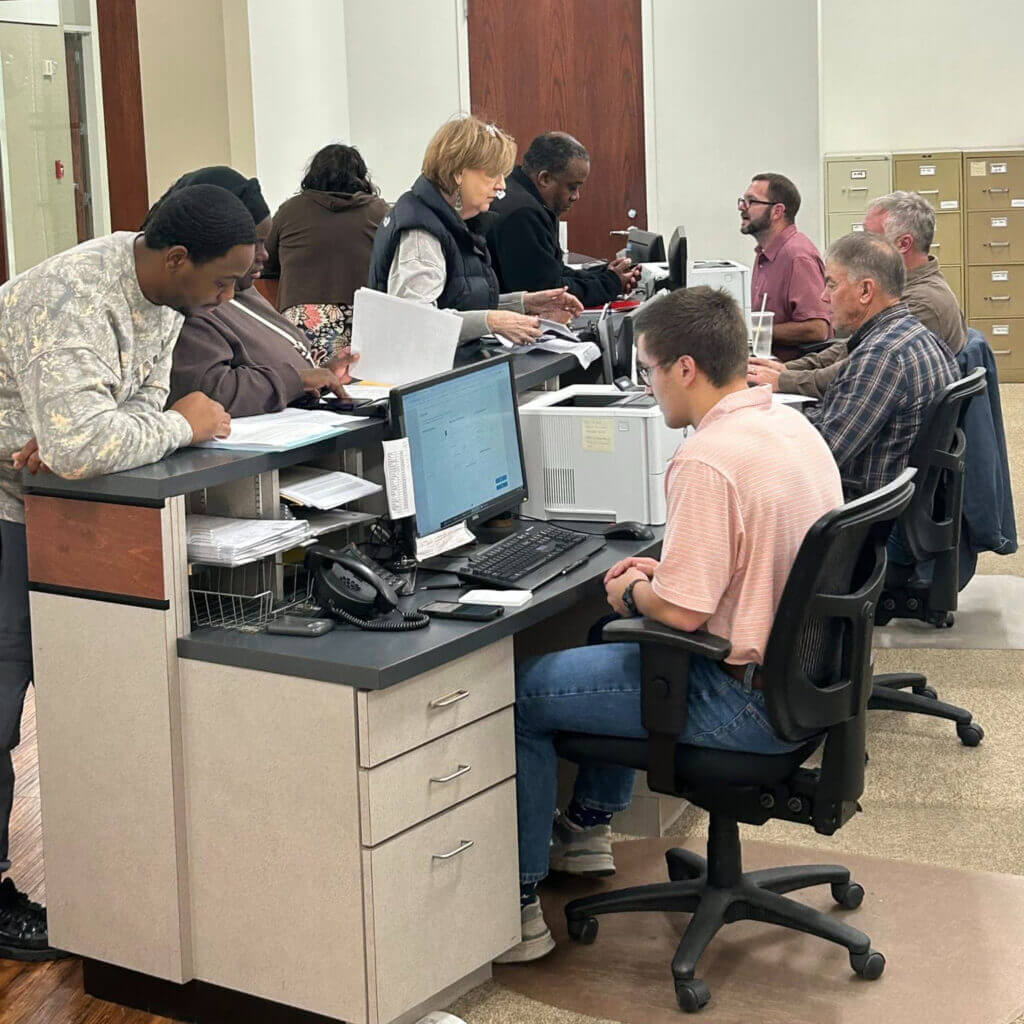

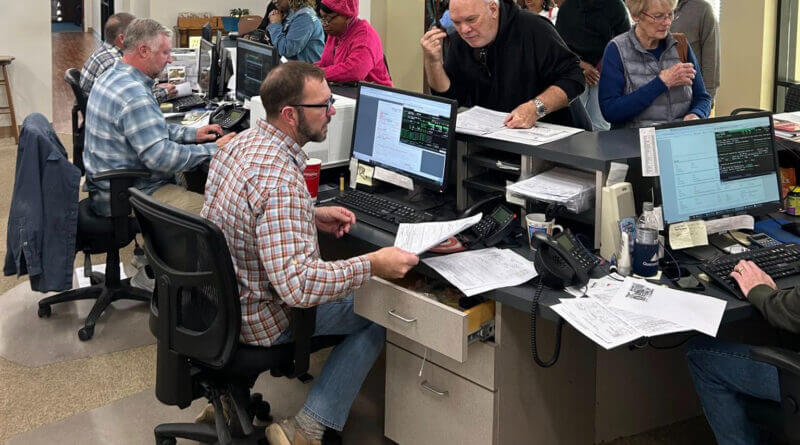

Photo: Residents are assisted by Tax Assessor’s office staff in applying for their Homestead Exemptions. (Jeff Fitch/Facebook)

HERNANDO, Miss. — The DeSoto County Tax Assessor’s office kicked off the property tax season with a historic surge in activity. Tax Assessor Jeff Fitch announced that his team processed 349 homestead exemption applications on Monday, Jan. 5, the first official day of the filing period.

The turnout shattered the previous single-day record by 55 applications. To manage the high volume, which saw a line of residents stretching out the door from 7:45 a.m. until mid-afternoon, staff members worked through their lunch breaks to provide uninterrupted service.

“I’m very proud of our team,” Fitch said on his Facebook page. “We never took a break and skipped lunch to ensure the best, fastest service possible. We never forget we work for you.”

What Homeowners Need to Know

While the first-day rush set a new benchmark for the office, Fitch reminded residents that there is still ample time to submit their paperwork. The filing period for the current tax year remains open until April 1 at 5:00 p.m.

The homestead exemption is a state-mandated credit that reduces the property tax burden on a resident’s primary home. However, the exemption is not automatic. Residents must apply in person at the Tax Assessor’s office to lock in their savings.

Who Should File?

Homeowners are required to file a new application if they fall into any of the following categories:

- New Homeowners: Anyone who purchased and occupied a home in DeSoto County during the previous calendar year.

- Senior Status: Residents who reached age 65 by Jan. 1 are eligible for a significantly higher exemption.

- Disability: Residents who became 100 percent disabled during the previous year.

- Veteran Status: Honorably discharged veterans aged 90 or older may qualify for a 100 percent Ad Valorem tax exemption on their homestead.

- Changes in Status: Those who have married, divorced, or changed the name on their property deed since their last filing.

Filing Requirements

To ensure a smooth process, the Tax Assessor’s office asks residents to bring the following documentation to the Hernando office:

- Recorded Warranty Deed: A copy of the deed filed with the Chancery Clerk.

- Settlement Statement: From the home purchase closing.

- Vehicle Information: Mississippi tag numbers for all vehicles owned by the applicant and spouse.

- Social Security Numbers: For all owners.

- Proof of Eligibility: A birth certificate or driver’s license for those over 65, or official VA/Social Security documentation for disability status.

The Tax Assessor’s Office is located at 365 Losher Street, Suite 100, Hernando, MS, and is open Monday through Friday from 8:00 a.m. to 5:00 p.m.

Images from Jeff Fitch’s Facebook page