Stevenson: The state income tax and the virtue of humility

Note: The following opinion-editorial article is written and provided by Jon Stevenson, a DeSoto County businessman and head of the DeSoto Integrity and Government Political Action Committee (DIGPAC). Opinions expressed are those of the author and not necessarily that of this publication.

By Jon Stevenson

Arguably, the Lieutenant Governor holds the most powerful single position in the government of the State of Mississippi. His ability to manage the Senate, control the legislative process, and set the agenda makes it difficult for the House or the Governor to overcome his powers. This influential position, when used wisely, is almost insurmountable. That is why it is stunning that this week, Lt. Gov. Delbert Hosemann was roundly defeated in the State Income Tax elimination debate—defeated by, of all things, a decimal point!

By all accounts, Governor Tate Reeves, Speaker of the House Jason White, and House Ways and Means Chairman Trey Lamar proposed and executed a legislative and media campaign unparalleled in Mississippi history. The legislation, HB1, along with their engagement with a vast number of interest groups across the state, created a moment of maximum pressure on the Lt. Governor and the Senate to bend to the will of the people to eliminate the state income tax. This has been a long-standing policy goal of Tate Reeves and was attempted before under House Speaker Philip Gunn.

Even this moment of maximum pressure should not have been enough to make the State Senate and the Lt. Governor yield to the House, the Governor, and the majority of the people. Delbert Hosemann is one of the most skilled political maneuverers to ever hold the office of Lt. Governor. His ability to stall, deflect pressure, and drive his own legislative priorities through the legislature is unmatched—except perhaps by Tate Reeves when he held the same office.

The modification to HB1, the House version of income tax elimination, was a brilliant move to both appear to eliminate the income tax while never actually doing so. The legislation included triggers that were so onerous to achieve as to make the eventual elimination of the income tax laughable. It would have allowed Hosemann to take credit for eliminating the income tax with low-information voters while never having to follow through—a politically brilliant strategy.

Unfortunately for Lt. Gov. Hosemann, hubris struck. Humility is considered one of the greatest virtues for a reason. It encourages careful consideration of one’s actions. It helps you recognize your own failings and the necessity of double- and triple-checking your work. It reminds you that rushing leads to mistakes.

One of the ways Lt. Governors control the legislative process is by delaying legislation until the end of the session, when they can exert maximum pressure to get bills passed by the deadlines the legislature imposes on itself. The legislature must conclude its business within three months, and this time constraint enables the Lt. Governor to dominate the agenda. Most of the time, this works in his favor but puts immense pressure on bill writers to rush legislation under tight deadlines.

In this high-pressure environment, it’s critical to cross every “t” and dot every “i”—and to ensure that all decimal points are in the right place. This misplaced decimal point became the undoing of the Lt. Governor’s plan. By placing the decimal in the wrong spot, the automatic trigger for the income tax cut shifted from a nearly impossible $340 million surplus to an easily attainable $3.4 million surplus for the cuts to take effect.

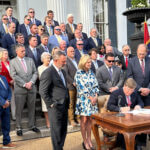

Seeing this, the House immediately passed the bill—despite major objections to many of its provisions—because they knew not to snatch defeat from the jaws of victory. The Governor signaled his intent to sign it for the same reason.

As a result, we will have a law that will make history and eliminate the income tax in this state, something that has never been done before. Workers will be incentivized to work harder and keep more of their earnings. This is a great day for the state and bodes well for the future—all because of a misplaced decimal point.