Homestead exemption deadline approaches

DeSoto County officials are reminding residents that a deadline is coming up for a homestead exemption they may be eligible for as a homeowner.

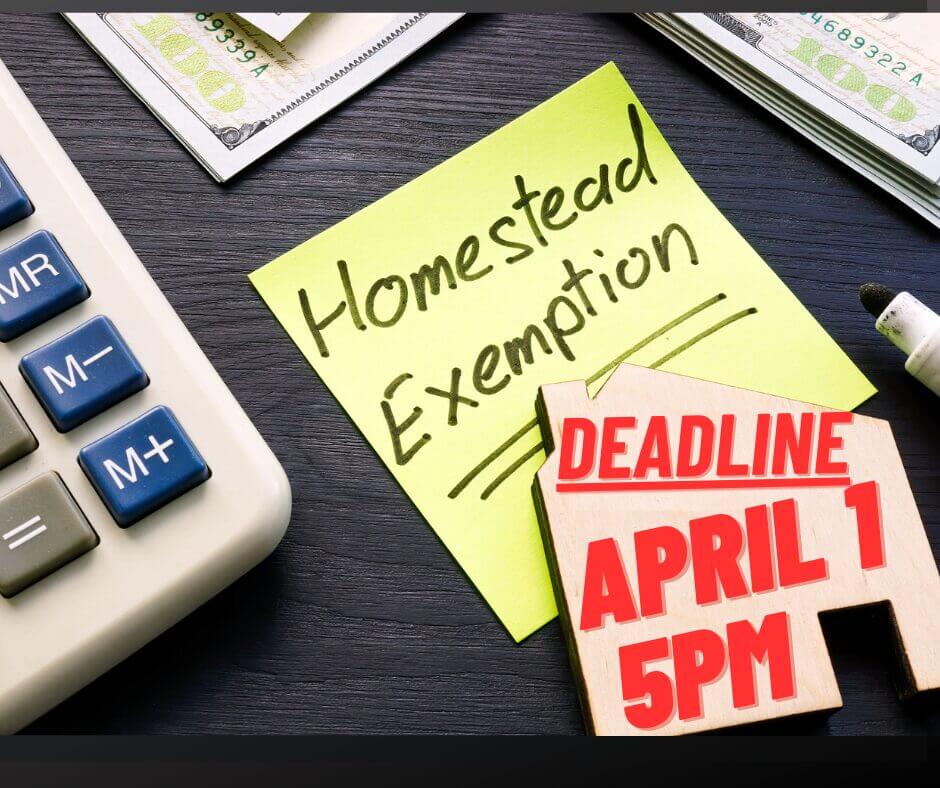

The deadline to file for the homestead exemption is at 5 p.m. on Monday, April 1. You may be eligible if you bought a new home in 2023, divorced, turned age 65, or become 100 percent disabled by the Social Security Administration (SSA).

HOMESTEAD EXEMPTION:

- Did you buy a home in 2023?

- Did you or your spouse turn 65 in 2023?

- Are you newly married or divorced and own a home?

- Did the name on your deed change?

- Are you certified 100 percent disabled?

These are just a few reasons you will need to apply or reapply for a Homestead Exemption. A Homestead Exemption reduces the property taxes people have to pay on their primary home.

County officials said that you can apply at the DeSoto County Tax Assessor’s Office located at 365 Losher Street, Suite 100, Hernando. Click on the link for additional information. https://www.desotocountyms.gov/99/Tax-Savings-Programs-Homestead