Simmons: Eliminating the state income tax is a risky gamble

Raising the gas tax adds insult to injury

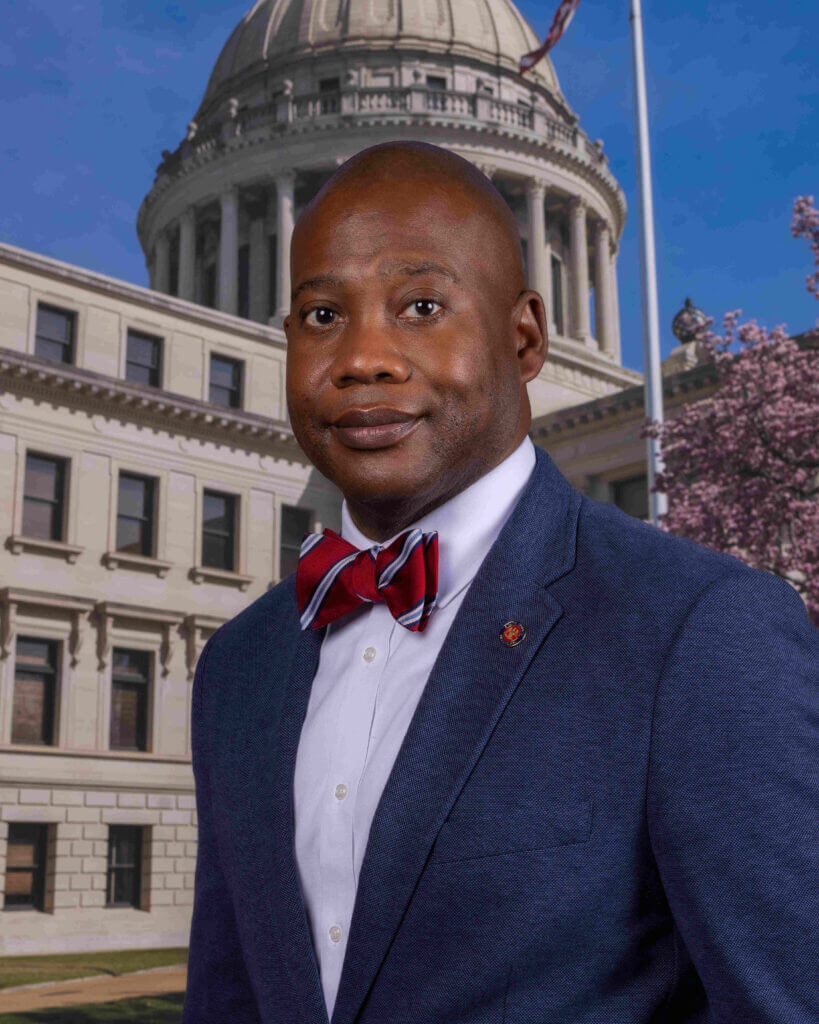

by Sen. Derrick T. Simmons (D-Greenville)

At the heart of sound economic policy is a basic principle: we should build a state that works for everyone—not just the wealthy few. That means investing in schools, maintaining roads, supporting hospitals, and ensuring working families aren’t left behind. It also means making responsible fiscal choices that protect our future.

Unfortunately, with the passage of House Bill 1, Mississippi has taken a step in the wrong direction.

At a time when our financial outlook is increasingly uncertain, the legislature approved a sweeping tax plan that eliminates the state income tax and raises the gas tax. Cutting the income tax will strip more than $2 billion from the state budget—money that supports our schools, hospitals, roads, and public safety. This reckless decision threatens the very services our economy and families rely on.

And the benefits won’t be shared equally. Mississippi’s wealthiest residents will receive a tax cut roughly equal to the average Mississippians yearly income. Meanwhile, families with low-income might save just enough to buy an extra gallon of milk each month.

Raising the gas tax only makes things worse. While eliminating the income tax benefits higher earners, increasing the gas tax hits rural and low-income Mississippians hardest—especially those who drive long distances for work, school, or basic services. Not to mention, retirees and those on fixed incomes simply can’t afford to pay more at the gas pump.

This is not tax reform. This is textbook regressive taxation in favor of the rich: shifting the tax burden from those most able to pay to those who are already stretched thin.

To make matters worse, a drafting error in the bill accelerates the tax cuts even faster than intended—shrinking revenue while we’re still absorbing the 2022 tax changes. And this is happening without a clear plan to cover essential costs like the new school funding formula or long-term health care obligations, especially as the state continues to reject Medicaid expansion.

Proponents claim this plan will boost the economy and attract new residents—but history says otherwise. States that eliminated income taxes haven’t seen the promised growth. Instead, they’ve raised sales and property taxes or relied on other revenue sources like tourism or oil revenue—neither of which Mississippi can count on. In places like Arizona, Kentucky, and Ohio, tax cuts have led to painful shortfalls and deep service cuts.

Passing laws not rooted in reality but on political ideology and wishful thinking is dangerous. According to the Mississippi Legislative Budget Office, from July 2024 to March 2025, the state collected $71.7 million less in revenue than it did during the same period last year—a drop of 1.36%. Also, the proposed general fund budget for the next fiscal year is $16.7 million less than what was appropriated for the current one. We are heading into a period of tighter budgets—and yet, we just cut our most reliable source of revenue.

This is especially risky given Mississippi’s reliance on federal funding. The recent surge in state revenue that drove some of the optimism behind the tax cut decision was fueled by temporary federal aid—primarily from the American Rescue Plan Act (ARPA). That funding is drying up.

Despite persistent misinformation that Mississippi doesn’t want so-called “federal handouts” —especially around Medicaid expansion, summer meals for children, or safety net programs like TANF and SNAP — the truth is this: federal revenue is the single largest source of funding for Mississippi’s state budget. It contributes more to our economy than all state tax collections and other revenue sources combined. Mississippi is the second most federally dependent state in the nation. Federal funds account for over 46% of our state budget—more than $14 billion out of a total $31 billion.

Now, we are already beginning to feel the effects of recent federal funding reductions under the Trump administration. The Mississippi Department of Education is set to lose $137 million in expiring COVID-related funds. The Department of Health faces more than $230 million in cuts to essential public and mental health programs. Even cultural and educational institutions like the Mississippi Humanities Council are bracing for a $1.5 million loss in federal support.

Passing a massive tax cut while federal funds disappear is like tearing the roof off your house just as storm clouds are rolling in. You might enjoy the sunlight for a minute, but you’re not ready for what’s coming next.

But the damage doesn’t end there.

The consequences of this short-sighted policy won’t end with this legislative session. When the shortfalls come—and they will—future legislatures will be forced to fill the gaps. The most politically convenient solution will be the most painful for working Mississippians—raising sales taxes on everyday necessities, increasing property taxes, or both. If that doesn’t work, we’ll see deep cuts to core public services. And if history is any guide, education will be the first on the chopping block. This would be another regressive move that pushes the cost of government even further onto working families and weakens our communities.

In times like these, we need leadership that plans ahead—not political stunts built on wishful thinking. A strong, stable economy doesn’t happen by accident. It requires responsible governance, forward-thinking policies, and the courage to serve all Mississippians—not just the wealthy few. If we want to attract businesses, support working families, and prepare for future growth, we must make smart, sustainable economic choices.

It doesn’t have to be this way.

We can choose a better path—one that protects essential services, invests in our people, and builds an economy where everyone contributes and everyone benefits. That’s the Mississippi our families deserve. That’s the future we should be fighting for.

Note: Sen. Derrick T. Simmons is the Minority Leader in the Mississippi State Senate.