Harris: Financial moves to consider for the New Year

By Charlestien Harris, Retired Financial Coach at Southern Bancorp

As we approach the end of December and the close of 2025, it’s a great time to review your financial decisions from the past year. Those choices may have significantly impacted your current financial picture. Here are a few suggestions to help you make some final money moves and start the new year on a positive note.

1. Pay Down or Pay Off Debt

Carrying old debt into the new year almost always puts you behind when it comes to keeping your budget on track. Try to pay off as much debt as possible before year-end. If you can’t pay the full amount, reduce it as much as you can to improve your balance sheet.

2. Take Your Required Minimum Distributions (RMDs)

If you are age 73 or older, you must withdraw a minimum amount from your traditional retirement accounts – such as IRAs and 401(k)s – by year-end to avoid a potential 25 percent IRS penalty on the amount you failed to withdraw. Check with your financial advisor for details. Not taking your RMD could significantly affect your current year’s tax bill, so do your research.

3. Track Your Spending Habits

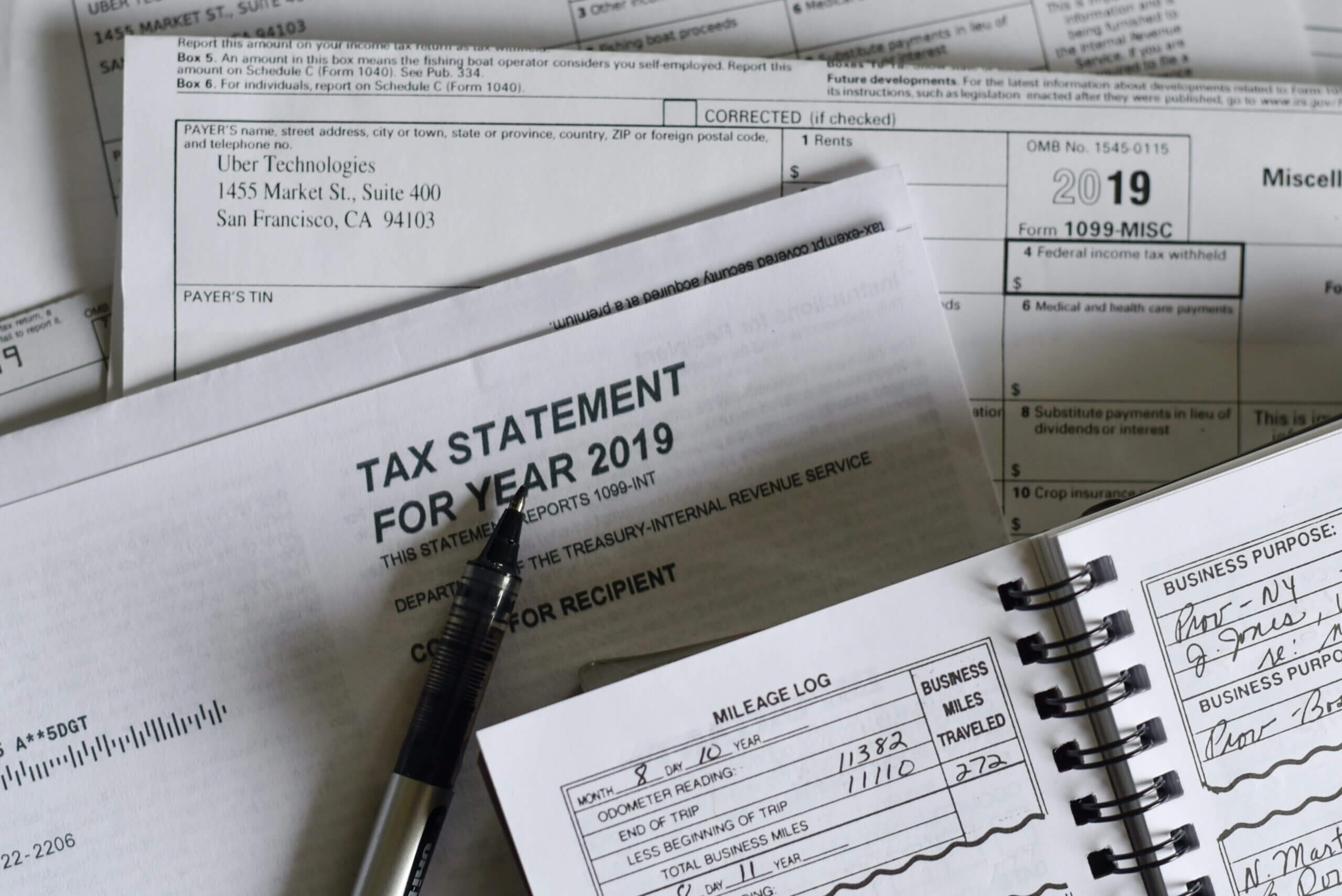

Start the new year by understanding where your money is actually going. Keep receipts, write down every purchase, and total your expenses. This exercise will help you review your budget, set financial goals for the upcoming year, and gather necessary documents for your 2025 tax preparation.

4. Reflect on Your Financial Goals

The last week of the year is the perfect time to review your goals and assess your progress. Ask yourself:

- Are there steps I can take before year-end to meet my financial goals?

- Do I need to adjust or amend any of my goals?

- Are there new goals I can start working toward?

5. Build or Boost Your Emergency Fund

Aim to save three to six months’ worth of essential living expenses in an easily accessible account to cover unexpected costs such as medical bills, emergencies, or job loss. Start small – $500 to $1,000 – and increase the amount as your budget allows.

6. Automate Your Finances

Set up automatic transfers from your checking account to your savings account to build healthy habits without relying on willpower. Automation can also help you avoid late payment fees, which can derail your budget. Ask your financial institution for details on setting up this process.

7. Plan for Major Future Expenses

Saving for big-ticket items – such as a down payment on a house, college tuition, or a major vacation – can help you stay on track. Proactive saving gives you a clearer picture of costs and helps you prepare. Stay flexible, though, because life is unpredictable, and you may need to adjust your goals.

These financial moves can help you stay on track with the new budget you’ve prepared. The new year may bring challenges, but pre-planning can help you manage surprises. For more information on this or other financial topics, email me at charlestienharris77@gmail.com or write to P.O. Box 1825, Clarksdale, Mississippi.

Until next week – stay financially fit!

Charlestien Harris is our financial contributor, a retired financial coach for Southern Bancorp.